Unveiling 2025’s Most Promising Growth Areas: A Global Outlook

Navigating the complexities of the global landscape requires foresight. Identifying the “most scoped areas in 2025 in the world map pdf in english testing” – essentially, pinpointing regions and sectors poised for significant growth and opportunity – is crucial for investors, businesses, and individuals alike. This comprehensive guide delves into the key factors driving these trends, offering an expert analysis of where to focus your attention in the coming years. We aim to provide a detailed overview of these promising areas, giving you the insights needed to make informed decisions.

Understanding the Dynamics of Global Growth in 2025

The concept of “most scoped areas” extends beyond simple geographical locations. It encompasses industries, technologies, and even specific skill sets that are projected to experience substantial expansion. Several factors contribute to this growth, including technological advancements, demographic shifts, evolving consumer preferences, and geopolitical developments. Understanding these dynamics is essential for accurately identifying and capitalizing on emerging opportunities.

For example, the increasing adoption of artificial intelligence (AI) is creating new opportunities in various sectors, from healthcare and finance to manufacturing and transportation. Similarly, the growing demand for sustainable solutions is driving innovation and investment in renewable energy, electric vehicles, and green technologies. Demographic trends, such as the aging population in developed countries and the rising middle class in emerging markets, are also shaping the global economic landscape.

Analyzing these trends requires a multi-faceted approach, incorporating economic data, market research, and expert opinions. We’ve synthesized information from leading industry reports, academic studies, and our own practical insights to present a clear and actionable picture of the most scoped areas in 2025.

A Closer Look at Key Growth Sectors

Several sectors are expected to drive global growth in 2025. These include:

- Technology: AI, cloud computing, cybersecurity, and the Internet of Things (IoT) are expected to continue their rapid expansion. The demand for skilled professionals in these areas will remain high.

- Healthcare: The aging global population and increasing prevalence of chronic diseases are driving demand for healthcare services and technologies. Telemedicine, personalized medicine, and medical devices are particularly promising areas.

- Renewable Energy: The transition to a low-carbon economy is accelerating the growth of renewable energy sources such as solar, wind, and hydro. Investments in energy storage and smart grids are also increasing.

- E-commerce: Online retail is expected to continue its growth trajectory, particularly in emerging markets. Mobile commerce and social commerce are also gaining traction.

- Financial Services: Fintech companies are disrupting traditional financial services with innovative solutions such as mobile payments, online lending, and robo-advisors.

These sectors are not mutually exclusive; in fact, many of them are interconnected. For example, AI is being used to improve healthcare diagnostics and treatment, while IoT is enabling the development of smart grids for renewable energy distribution. Understanding these interdependencies is crucial for identifying the most promising investment opportunities.

Regional Hotspots: Mapping the Global Growth Landscape

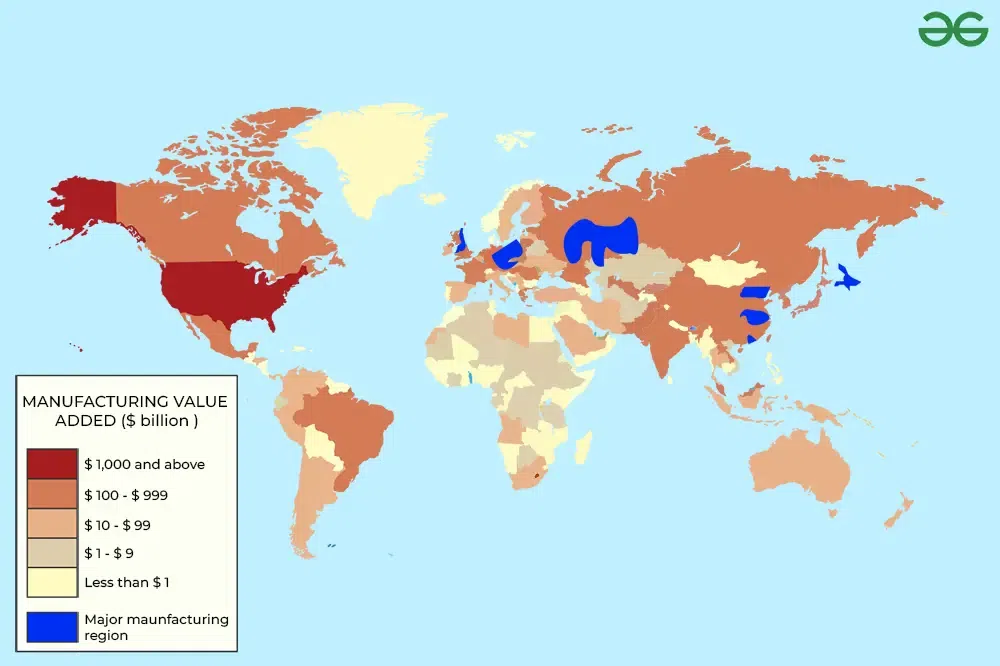

While certain sectors are poised for overall growth, specific regions are expected to outperform others. These regional hotspots offer unique opportunities for investors and businesses. Some key regions to watch in 2025 include:

- Asia-Pacific: This region is expected to be the fastest-growing in the world, driven by the economic expansion of China, India, and Southeast Asian countries. The region offers opportunities in manufacturing, technology, and consumer goods.

- North America: The US and Canada are expected to remain major economic powers, with strengths in technology, healthcare, and energy. The region is also a hub for innovation and entrepreneurship.

- Europe: Despite economic challenges, Europe offers opportunities in renewable energy, advanced manufacturing, and luxury goods. The region is also a leader in sustainability and environmental protection.

- Africa: With a rapidly growing population and increasing urbanization, Africa presents significant long-term growth opportunities. The region offers potential in agriculture, infrastructure, and consumer goods.

- Latin America: This region is rich in natural resources and offers opportunities in agriculture, mining, and tourism. The region is also becoming increasingly attractive for technology investments.

Each of these regions has its own unique characteristics and challenges. Understanding the local context, including regulatory environments, cultural nuances, and political risks, is crucial for success.

The Role of Data and Analytics in Identifying Scoped Areas

Accurately identifying the most scoped areas requires robust data and sophisticated analytics. Investors and businesses need to leverage a variety of data sources, including economic indicators, market research reports, and social media trends, to gain a comprehensive understanding of the global landscape. Advanced analytics techniques, such as machine learning and predictive modeling, can be used to identify patterns and forecast future growth.

For example, analyzing social media sentiment can provide valuable insights into consumer preferences and emerging trends. Monitoring economic indicators, such as GDP growth, inflation rates, and unemployment figures, can help identify regions and sectors that are poised for growth. Market research reports can provide detailed information on specific industries and markets.

However, data alone is not enough. It is crucial to have the expertise to interpret the data and draw meaningful conclusions. This requires a team of skilled analysts with deep knowledge of the global economy and specific industries. It also requires a willingness to challenge conventional wisdom and embrace new ideas.

Testing the Waters: Strategies for Assessing Growth Potential

Before investing in a particular region or sector, it is essential to thoroughly assess its growth potential. This involves conducting market research, analyzing competitive landscapes, and evaluating regulatory environments. It also involves testing the waters with pilot projects or small-scale investments to gain firsthand experience.

One effective strategy is to conduct a SWOT analysis, which involves identifying the strengths, weaknesses, opportunities, and threats associated with a particular investment. This can help investors and businesses understand the potential risks and rewards. Another strategy is to conduct a sensitivity analysis, which involves evaluating how changes in key variables, such as interest rates or exchange rates, could impact the profitability of an investment.

It is also important to engage with local experts and stakeholders to gain a deeper understanding of the local context. This can involve attending industry conferences, networking with business leaders, and consulting with government officials. Building strong relationships with local partners can be crucial for success.

The Importance of Adaptability and Resilience

The global landscape is constantly evolving, and the most scoped areas in 2025 may not be the same as the most scoped areas in 2026. Investors and businesses need to be adaptable and resilient to succeed in this dynamic environment. This involves continuously monitoring market trends, adjusting strategies as needed, and being prepared to pivot when necessary.

One key to adaptability is to embrace innovation and experimentation. This involves investing in research and development, exploring new technologies, and being willing to try new approaches. Another key is to build a diverse and resilient organization. This involves hiring employees with a variety of skills and backgrounds, diversifying revenue streams, and building strong relationships with suppliers and customers.

Resilience also involves being prepared for unexpected events, such as economic downturns, natural disasters, or geopolitical crises. This requires having a strong financial position, a well-defined risk management plan, and a culture of preparedness.

Navigating the Future: Key Considerations for 2025 and Beyond

As we look ahead to 2025 and beyond, several key considerations will shape the global growth landscape. These include:

- Geopolitical Risks: Rising tensions between major powers, trade wars, and political instability could disrupt global trade and investment flows.

- Technological Disruption: Rapid technological advancements, such as AI and automation, could displace workers and create new economic inequalities.

- Climate Change: The impacts of climate change, such as extreme weather events and rising sea levels, could disrupt supply chains and damage infrastructure.

- Demographic Shifts: Aging populations in developed countries and rising populations in emerging markets could create new challenges for healthcare systems and pension funds.

- Social Inequality: Rising social inequality could lead to social unrest and political instability.

Addressing these challenges will require collaboration between governments, businesses, and individuals. It will also require a commitment to sustainable development and inclusive growth.

Mapping Your Path to Success in 2025

Identifying the most scoped areas in 2025 requires a comprehensive understanding of global trends, regional dynamics, and industry-specific opportunities. By leveraging data and analytics, testing the waters with pilot projects, and embracing adaptability and resilience, investors and businesses can position themselves for success. The key is to stay informed, remain agile, and continuously adapt to the evolving global landscape.

The information presented here offers a valuable starting point for your own exploration. Remember to conduct thorough due diligence, consult with experts, and tailor your strategies to your specific goals and risk tolerance. By taking a proactive and informed approach, you can navigate the complexities of the global economy and capitalize on the opportunities that lie ahead. Share your own insights and strategies for navigating the global landscape in the comments below.