Decoding 2025 Bi-Weekly Pay: Which Months Deliver 3 Paychecks?

Navigating the complexities of bi-weekly pay schedules can sometimes feel like deciphering a secret code, especially when anticipating those rare months that bring an extra paycheck. If you’re on a bi-weekly payment schedule, you’re likely familiar with the standard rhythm of receiving a paycheck every other week. However, the calendar occasionally aligns in such a way that a few months out of the year deliver a delightful surprise: three paychecks instead of the usual two. This article provides a comprehensive guide on understanding the bi-weekly pay system, pinpointing which months in 2025 will feature this extra payday, and maximizing the financial benefits of these occurrences.

Our goal is to provide you with the definitive resource on this topic, offering not just dates but also actionable insights into budgeting, saving, and financial planning around these 3-paycheck months. We’ll delve into the mechanics of bi-weekly pay, explore the specific months in 2025 where you can expect an extra payday, and offer expert advice on how to leverage these windfalls for your financial advantage. We aim to empower you with the knowledge to confidently manage your finances and make the most of every paycheck.

Understanding the Bi-Weekly Pay System

The bi-weekly pay system is a common payroll method where employees are paid every two weeks, resulting in 26 paychecks per year. This contrasts with semi-monthly pay (twice a month, resulting in 24 paychecks) or weekly pay (52 paychecks per year). The bi-weekly structure creates a consistent cadence for employees, making budgeting and bill payments relatively straightforward. However, because there are slightly more than four weeks in a month, this system leads to the occasional month with three paychecks. This is a crucial concept to understand for effective financial planning.

Calculating Your Bi-Weekly Pay

To understand the impact of those three-paycheck months, it’s vital to know how your bi-weekly pay is calculated. Typically, your annual salary is divided by 26 (the number of bi-weekly pay periods in a year). For example, if your annual salary is $65,000, your gross bi-weekly pay would be $2,500 ($65,000 / 26 = $2,500). From this gross amount, taxes, insurance premiums, and other deductions are subtracted to arrive at your net pay.

The Advantage of Bi-Weekly Pay

One of the main advantages of bi-weekly pay is the predictability it offers. Knowing you’ll receive a paycheck every other week allows for better budgeting and planning. It also aligns well with many recurring bills, such as rent or mortgage payments, which are typically due monthly. However, the real advantage comes during those months with three paychecks, providing an opportunity to accelerate your financial goals.

Identifying the 3-Paycheck Months in 2025

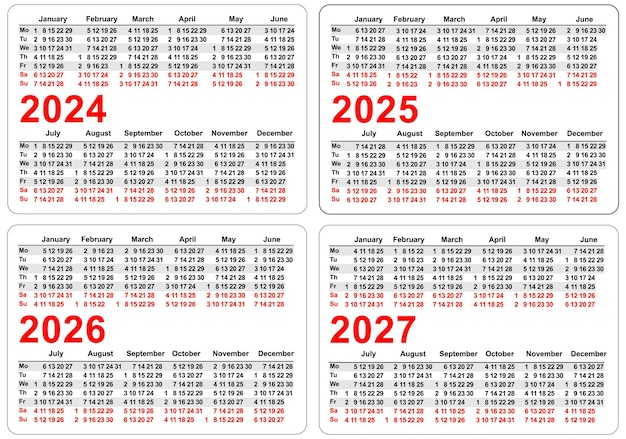

The key question is: which months in 2025 will feature three paychecks for those on a bi-weekly schedule? To determine this, you need to know your company’s specific pay schedule. However, we can provide a general guideline. If your company’s first payday of 2025 falls on a Wednesday, then the 3-paycheck months will likely be May and October. If the first payday is a Thursday, then you can likely expect the 3-paycheck months to be in January and July. Consult your payroll department or HR to confirm your company’s specific pay dates to accurately identify your 3-paycheck months.

Why These Months?

The occurrence of three-paycheck months is simply a mathematical consequence of the bi-weekly pay system and the Gregorian calendar. Because a year has 52 weeks (plus one or two days, depending on leap years), a bi-weekly pay schedule will inevitably result in 26 pay periods. This means that some months will contain two pay periods, while others will contain three. It’s not a special bonus or a change in your salary; it’s simply an artifact of the pay cycle.

How to Accurately Determine Your 3-Paycheck Months

The most reliable way to determine your 3-paycheck months is to consult your company’s payroll calendar or HR department. These resources will provide the exact pay dates for 2025, allowing you to easily identify the months where you’ll receive three paychecks. Another method is to mark your paydays on a physical calendar. Start with your first payday of 2025 and then mark every two weeks thereafter. The months with three marks are your 3-paycheck months.

Leveraging the Extra Paychecks: Financial Strategies

Those 3-paycheck months present a golden opportunity to boost your financial well-being. Here are some strategies to maximize the benefit of these extra paydays:

- Accelerate Debt Repayment: Use the extra income to make an additional payment on your highest-interest debt, such as credit cards or personal loans. This can significantly reduce your overall interest costs and help you become debt-free faster.

- Boost Your Savings: Increase your contributions to your savings accounts, whether it’s a general savings account, an emergency fund, or a specific savings goal like a down payment on a house.

- Invest for the Future: Consider investing the extra income in a retirement account, such as a 401(k) or IRA, or in other investment vehicles like stocks or bonds. This can help you build wealth over the long term.

- Fund a Specific Goal: Use the extra income to fund a specific financial goal, such as a vacation, a new car, or a home improvement project.

- Build Your Emergency Fund: If you don’t already have an emergency fund, use the extra paychecks to start building one. Aim for at least 3-6 months’ worth of living expenses in a readily accessible account.

- Treat Yourself (Responsibly): While it’s important to prioritize your financial goals, it’s also okay to treat yourself occasionally. Allocate a small portion of the extra income to something you enjoy, such as a nice dinner or a new gadget, to avoid burnout and stay motivated.

Budgeting for 3-Paycheck Months

Effective budgeting is crucial for maximizing the benefits of 3-paycheck months. Plan ahead by incorporating these extra paychecks into your budget. Consider creating a separate budget specifically for these months, allocating the extra income to your financial goals. Review your budget regularly to ensure you’re on track and making the most of the extra income.

Payroll Software and Bi-Weekly Pay Management

Many businesses utilize payroll software to streamline the process of managing bi-weekly pay schedules and ensure accurate and timely payments. These software solutions automate calculations, deductions, and tax withholdings, reducing the risk of errors and saving time. Some popular payroll software options include:

- Gusto: A user-friendly platform that offers comprehensive payroll services, including automatic tax filings and direct deposit.

- Paychex: A well-established payroll provider that offers a range of services, from basic payroll processing to HR solutions.

- ADP: A leading payroll and HR solutions provider that caters to businesses of all sizes.

- QuickBooks Payroll: A popular option for small businesses that integrates seamlessly with QuickBooks accounting software.

Benefits of Using Payroll Software

Using payroll software offers several benefits, including:

- Accuracy: Automates calculations and reduces the risk of errors.

- Efficiency: Saves time and simplifies the payroll process.

- Compliance: Helps ensure compliance with tax laws and regulations.

- Reporting: Provides detailed payroll reports for analysis and tracking.

- Employee Self-Service: Allows employees to access their pay stubs and W-2 forms online.

The Impact of Taxes on Your Bi-Weekly Pay

Understanding how taxes are withheld from your bi-weekly pay is essential for effective financial planning. Your employer withholds federal, state, and local taxes from each paycheck based on your W-4 form. The amount withheld depends on your income, filing status, and any deductions or credits you claim.

Tax Planning for 3-Paycheck Months

While the extra paycheck in a 3-paycheck month is not taxed differently, it can impact your overall tax liability. Because your income is spread out over more paychecks, you may be in a slightly higher tax bracket during those months. However, this is usually a minor effect. It’s always a good idea to review your W-4 form periodically and adjust it as needed to ensure you’re not overpaying or underpaying your taxes.

Consulting a Tax Professional

If you have complex tax situations or are unsure about how your bi-weekly pay affects your tax liability, consider consulting a tax professional. A tax advisor can provide personalized guidance and help you optimize your tax strategy.

Maximizing Your Financial Well-being with a Bi-Weekly Pay Schedule

The bi-weekly pay schedule, while seemingly straightforward, offers unique opportunities for financial growth, particularly during those months where the calendar aligns to deliver three paychecks. Understanding the nuances of this system, planning for these extra paydays, and leveraging them strategically can significantly impact your financial well-being. Whether you choose to accelerate debt repayment, boost your savings, invest for the future, or fund a specific goal, the key is to be intentional and proactive in your financial planning.

By taking the time to understand your bi-weekly pay schedule and plan for those 3-paycheck months, you can take control of your finances and achieve your financial goals faster. Remember to consult your payroll department or HR to confirm your company’s specific pay dates and seek professional advice when needed. Here’s to making the most of every paycheck in 2025 and beyond!