Euro to Dollar Forecast 2025: Expert Analysis and Predictions

Navigating the complex world of currency exchange rates can feel like charting a course through uncharted waters. For businesses, investors, and individuals alike, understanding the potential trajectory of the Euro to Dollar (EUR/USD) exchange rate is crucial for making informed financial decisions. As we look ahead to 2025, the question on everyone’s mind is: Where is the EUR/USD exchange rate headed? This comprehensive guide provides an in-depth analysis of the factors influencing the euro to dollar forecast 2025, offering expert predictions and insights to help you navigate the currency markets with confidence. We’ll delve into economic indicators, geopolitical events, and expert opinions to paint a clearer picture of what the future may hold.

Understanding the Dynamics of EUR/USD Exchange Rate

The EUR/USD exchange rate represents the value of the Euro against the US Dollar. It indicates how many US dollars are needed to purchase one Euro. This rate is constantly fluctuating, influenced by a complex interplay of economic, political, and social factors. Understanding these dynamics is essential for anyone attempting to forecast future movements.

Key Economic Indicators

Several economic indicators play a crucial role in shaping the EUR/USD exchange rate:

- Interest Rates: The interest rates set by the European Central Bank (ECB) and the Federal Reserve (Fed) are major drivers. Higher interest rates tend to attract foreign investment, increasing demand for the currency and strengthening its value.

- Inflation Rates: Inflation erodes the purchasing power of a currency. Higher inflation in the Eurozone compared to the US could weaken the Euro against the Dollar.

- Gross Domestic Product (GDP) Growth: A strong and growing economy typically supports a stronger currency. Relative GDP growth rates between the Eurozone and the US can significantly impact the exchange rate.

- Unemployment Rates: Lower unemployment rates generally indicate a healthy economy, which can boost the currency’s value.

- Trade Balance: A country with a trade surplus (exporting more than it imports) tends to have a stronger currency due to increased demand for its goods and services.

Geopolitical Events and Market Sentiment

Beyond economic data, geopolitical events and market sentiment can also significantly impact the EUR/USD exchange rate. Unexpected events, such as political instability, trade wars, or global pandemics, can trigger volatility and influence investor confidence. Market sentiment, driven by news headlines and speculation, can also lead to short-term fluctuations.

Expert Insights on EUR/USD Forecast 2025

Forecasting currency exchange rates is not an exact science. However, by analyzing historical data, current economic conditions, and expert opinions, we can develop informed predictions about the potential direction of the EUR/USD exchange rate in 2025. Several leading financial institutions and economic analysts offer their perspectives on the future of the EUR/USD pair.

Note: These forecasts are based on current information and models, and are subject to change as new data becomes available. Always consult with a financial advisor before making any investment decisions.

Scenario 1: Euro Strengthens Against the Dollar

This scenario assumes that the Eurozone economy experiences stronger growth than the US economy. This could be driven by factors such as increased government spending, successful implementation of structural reforms, or a rebound in global trade. In this scenario, the ECB might start raising interest rates to combat inflation, further supporting the Euro’s value. A potential EUR/USD forecast for 2025 in this scenario could see the pair trading in the range of 1.15 to 1.25.

Scenario 2: Dollar Strengthens Against the Euro

This scenario assumes that the US economy continues to outperform the Eurozone economy. This could be driven by factors such as strong consumer spending, technological innovation, or a favorable regulatory environment. In this scenario, the Fed might continue raising interest rates to control inflation, attracting foreign investment and strengthening the Dollar. A potential EUR/USD forecast for 2025 in this scenario could see the pair trading in the range of 0.95 to 1.05.

Scenario 3: Range-Bound Trading

This scenario assumes that the Eurozone and US economies grow at similar rates, with no significant divergence in monetary policy. In this scenario, the EUR/USD exchange rate might trade within a relatively narrow range, influenced by short-term economic data releases and geopolitical events. A potential EUR/USD forecast for 2025 in this scenario could see the pair trading in the range of 1.05 to 1.15.

The Role of Monetary Policy in Shaping the Forecast

Monetary policy, as implemented by central banks like the European Central Bank (ECB) and the Federal Reserve (FED), is a cornerstone of currency valuation. Understanding the nuances of their approaches is vital when considering the euro to dollar forecast 2025.

ECB’s Stance and Its Impact

The European Central Bank’s (ECB) primary mandate is to maintain price stability within the Eurozone. To achieve this, the ECB uses various tools, including setting interest rates, managing the money supply, and implementing quantitative easing programs. The ECB’s policy decisions can have a significant impact on the Euro’s value. For example, if the ECB raises interest rates, it can attract foreign investment, increasing demand for the Euro and strengthening its value against the Dollar.

Federal Reserve’s Strategy and Its Influence

The Federal Reserve (Fed), the central bank of the United States, also plays a crucial role in shaping the EUR/USD exchange rate. The Fed’s monetary policy decisions, such as setting interest rates and managing the money supply, can influence the Dollar’s value. If the Fed raises interest rates, it can attract foreign investment, increasing demand for the Dollar and strengthening its value against the Euro.

Divergence in Monetary Policies

The relative stance of the ECB and the Fed is a key driver of the EUR/USD exchange rate. If the ECB is more hawkish (inclined to raise interest rates) than the Fed, the Euro is likely to strengthen against the Dollar. Conversely, if the Fed is more hawkish than the ECB, the Dollar is likely to strengthen against the Euro. The market’s expectation of future monetary policy decisions also plays a significant role.

Geopolitical Risks and Their Potential Impact

Geopolitical risks can introduce significant volatility into the currency markets. Events such as political instability, trade wars, and international conflicts can disrupt economic activity and investor sentiment, leading to fluctuations in the EUR/USD exchange rate. Staying informed about these risks is crucial for anyone attempting to forecast the future direction of the currency pair.

Political Instability in the Eurozone

Political instability within the Eurozone can create uncertainty and weaken the Euro. Events such as elections, referendums, or government crises can trigger concerns about the future of the Eurozone economy and the stability of the Euro. For example, if a major Eurozone country experiences a political crisis, investors may lose confidence in the Euro and sell their holdings, driving down its value.

Trade Wars and Protectionism

Trade wars and protectionist policies can disrupt global trade flows and negatively impact economic growth, leading to fluctuations in the EUR/USD exchange rate. For example, if the US and the Eurozone impose tariffs on each other’s goods, it can reduce trade between the two regions, hurting their economies and weakening their currencies.

International Conflicts and Crises

International conflicts and crises can also significantly impact the EUR/USD exchange rate. Events such as wars, terrorist attacks, or natural disasters can disrupt economic activity and investor sentiment, leading to increased volatility in the currency markets. For example, if a major international conflict erupts, investors may flock to safe-haven currencies like the US Dollar, driving up its value against the Euro.

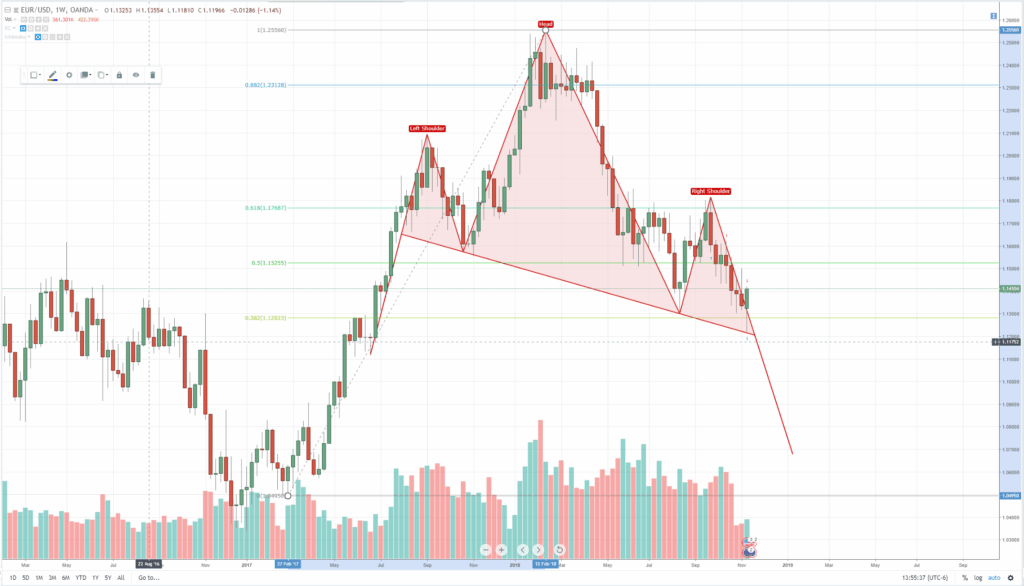

Analyzing Technical Indicators for EUR/USD

Technical analysis involves studying historical price charts and using various indicators to identify patterns and predict future price movements. While technical analysis should not be the sole basis for making investment decisions, it can provide valuable insights into potential support and resistance levels, trend directions, and momentum shifts. Here are some commonly used technical indicators for analyzing the EUR/USD exchange rate:

- Moving Averages: Moving averages smooth out price data over a specific period, helping to identify trends. Common moving averages include the 50-day, 100-day, and 200-day moving averages.

- Relative Strength Index (RSI): The RSI is a momentum indicator that measures the magnitude of recent price changes to evaluate overbought or oversold conditions in the market.

- Moving Average Convergence Divergence (MACD): The MACD is a trend-following momentum indicator that shows the relationship between two moving averages of a security’s price.

- Fibonacci Retracement Levels: Fibonacci retracement levels are horizontal lines that indicate potential support and resistance levels based on Fibonacci ratios.

The Impact of Global Economic Trends

Global economic trends, such as changes in commodity prices, technological advancements, and demographic shifts, can also influence the EUR/USD exchange rate. Understanding these trends is crucial for developing a comprehensive forecast.

Commodity Prices

Changes in commodity prices, particularly oil prices, can impact the EUR/USD exchange rate. Higher oil prices can negatively affect the Eurozone economy, as it is a net importer of oil. This can weaken the Euro against the Dollar. Conversely, lower oil prices can benefit the Eurozone economy, potentially strengthening the Euro.

Technological Advancements

Technological advancements can also influence the EUR/USD exchange rate. Countries that are at the forefront of technological innovation tend to have stronger economies and currencies. For example, if the US experiences faster technological growth than the Eurozone, it could strengthen the Dollar against the Euro.

Demographic Shifts

Demographic shifts, such as aging populations and declining birth rates, can also impact the EUR/USD exchange rate. Countries with aging populations may experience slower economic growth, which can weaken their currencies. For example, if the Eurozone’s population ages more rapidly than the US population, it could put downward pressure on the Euro.

Inflation Dynamics: A Core Driver

Inflation, the rate at which the general level of prices for goods and services is rising, is a critical determinant of currency value. Disparities in inflation rates between the Eurozone and the United States can significantly impact the euro to dollar forecast 2025.

Eurozone Inflation

Monitoring inflation trends within the Eurozone is crucial for assessing the Euro’s strength. Higher inflation in the Eurozone can erode the purchasing power of the Euro, making it less attractive to investors. The ECB closely monitors inflation and adjusts its monetary policy accordingly. If the ECB believes that inflation is too high, it may raise interest rates to cool down the economy and stabilize prices.

US Inflation

Similarly, tracking inflation trends in the United States is essential for evaluating the Dollar’s strength. Higher inflation in the US can erode the purchasing power of the Dollar, making it less attractive to investors. The Fed also closely monitors inflation and adjusts its monetary policy accordingly. If the Fed believes that inflation is too high, it may raise interest rates to cool down the economy and stabilize prices.

Relative Inflation Rates

The relative difference in inflation rates between the Eurozone and the US is a key driver of the EUR/USD exchange rate. If the Eurozone has higher inflation than the US, the Euro is likely to weaken against the Dollar. Conversely, if the US has higher inflation than the Eurozone, the Dollar is likely to weaken against the Euro.

Currency Hedging Strategies for Businesses

For businesses that operate internationally, managing currency risk is essential for protecting their profits and cash flows. Currency hedging involves using financial instruments to mitigate the impact of exchange rate fluctuations. Several currency hedging strategies are available, including:

- Forward Contracts: A forward contract is an agreement to buy or sell a specific amount of currency at a predetermined exchange rate on a future date. This can help businesses lock in a known exchange rate and protect themselves from adverse currency movements.

- Currency Options: A currency option gives the buyer the right, but not the obligation, to buy or sell a specific amount of currency at a predetermined exchange rate on or before a future date. This can provide businesses with flexibility and protection against downside risk.

- Currency Swaps: A currency swap involves exchanging principal and interest payments on a loan in one currency for principal and interest payments on a loan in another currency. This can help businesses manage their currency exposure and reduce borrowing costs.

Looking Ahead: Key Factors to Watch

As we approach 2025, several key factors will likely influence the EUR/USD exchange rate. Monitoring these factors closely will be crucial for anyone attempting to forecast the future direction of the currency pair.

- ECB and Fed Monetary Policy Decisions: The relative stance of the ECB and the Fed will continue to be a major driver of the EUR/USD exchange rate.

- Economic Growth in the Eurozone and the US: Relative economic growth rates between the two regions will also play a significant role.

- Geopolitical Risks: Geopolitical events, such as political instability, trade wars, and international conflicts, can introduce volatility into the currency markets.

- Inflation Trends: Monitoring inflation trends in both the Eurozone and the US will be essential for assessing the strength of the Euro and the Dollar.

Navigating the Forex Markets with Confidence

Predicting the euro to dollar forecast 2025 accurately requires a deep understanding of various interconnected factors. While no forecast is guaranteed, staying informed, analyzing market trends, and considering expert opinions can significantly improve your ability to navigate the Forex markets with confidence. Remember to consult with a financial advisor before making any investment decisions, and always manage your risk appropriately.

The insights shared here provide a solid foundation for making informed decisions, whether you’re a business planning international transactions or an individual investor seeking to capitalize on currency movements. We encourage you to share your thoughts and experiences with EUR/USD forecasting in the comments below, fostering a collaborative learning environment. For more in-depth analysis and personalized guidance, explore our range of resources and connect with our team of financial experts today.