TQQQ Stock Forecast 2025: Expert Analysis and Projections

Are you researching the potential of TQQQ and seeking a reliable TQQQ stock forecast for 2025? Understanding the trajectory of leveraged ETFs like TQQQ requires a comprehensive analysis that considers market trends, economic indicators, and the inherent risks associated with such instruments. This article provides an in-depth, expertly researched forecast for TQQQ in 2025, equipping you with the knowledge to make informed investment decisions. We delve into the factors influencing TQQQ’s performance, offering a balanced perspective that acknowledges both its potential for high returns and the significant risks involved. Our analysis combines technical insights with a practical understanding of market dynamics, giving you a clear picture of what to expect.

Understanding TQQQ: A Leveraged Bet on the Nasdaq-100

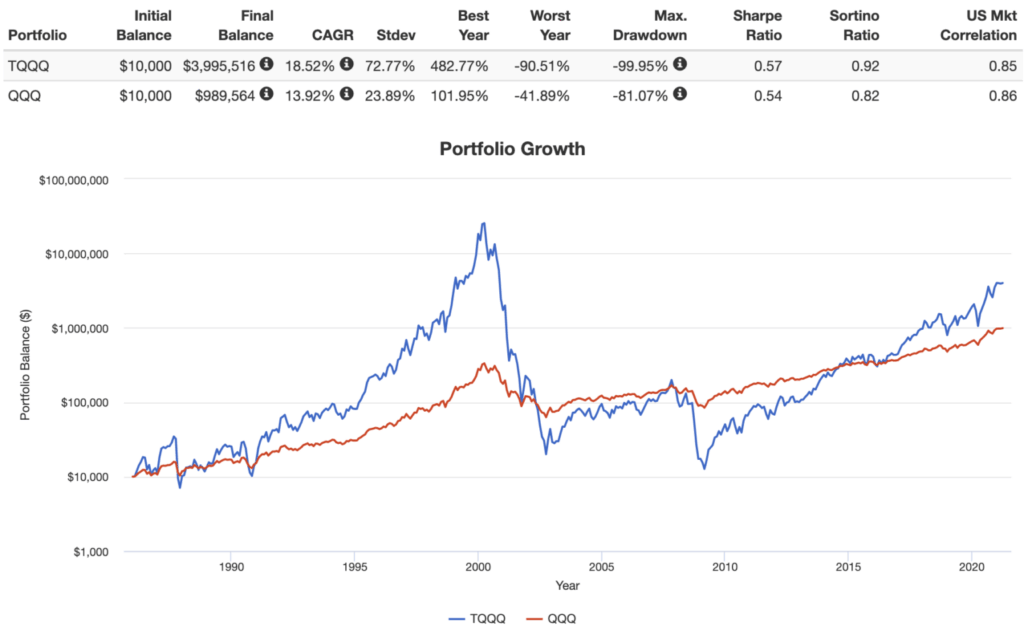

TQQQ, the ProShares UltraPro QQQ, is a leveraged exchange-traded fund (ETF) designed to deliver three times the daily performance of the Nasdaq-100 index. This index comprises 100 of the largest non-financial companies listed on the Nasdaq Stock Market. TQQQ’s leveraged nature means that it amplifies both the gains and losses of the Nasdaq-100. While this can lead to substantial returns in a bullish market, it also exposes investors to significantly higher risk during downturns. Unlike traditional ETFs that track an index on a one-to-one basis, TQQQ uses financial derivatives and leverage to achieve its 3x exposure. This mechanism resets daily, meaning that the fund’s performance over longer periods can deviate significantly from three times the Nasdaq-100’s performance, especially in volatile markets.

The allure of TQQQ lies in its potential for rapid wealth accumulation. During periods of strong market growth, TQQQ can generate returns that far exceed those of unleveraged investments. However, it’s crucial to recognize that this potential comes with increased risk. The daily reset mechanism can lead to a phenomenon known as volatility decay, where the fund’s value erodes over time, even if the underlying index experiences overall gains. This is particularly pronounced in sideways or choppy markets. Investors should carefully consider their risk tolerance and investment horizon before investing in TQQQ. It is generally not suitable for long-term buy-and-hold strategies but can be a powerful tool for experienced traders who actively manage their positions.

The Nasdaq-100: TQQQ’s Foundation

The Nasdaq-100 is a stock market index that includes 100 of the largest non-financial companies listed on the Nasdaq stock exchange. It’s a modified capitalization-weighted index, meaning that larger companies have a greater influence on its overall performance. The index is heavily weighted towards technology companies, but also includes businesses in sectors such as consumer discretionary, healthcare, and telecommunications. Companies like Apple, Microsoft, Amazon, and Google (Alphabet) typically hold significant positions in the Nasdaq-100. Understanding the composition and performance of the Nasdaq-100 is crucial for anyone considering an investment in TQQQ, as TQQQ’s returns are directly tied to the index’s movements.

The Nasdaq-100 has historically been a growth-oriented index, driven by innovation and technological advancements. Its performance is often influenced by factors such as interest rates, economic growth, and investor sentiment towards technology stocks. A strong and growing economy, coupled with low interest rates, typically creates a favorable environment for the Nasdaq-100. Conversely, economic slowdowns or rising interest rates can put downward pressure on the index. Investors should closely monitor these macroeconomic factors when assessing the potential performance of both the Nasdaq-100 and TQQQ.

Factors Influencing TQQQ’s Performance in 2025

Several key factors will likely influence TQQQ’s performance in 2025. These include:

- Interest Rate Environment: The Federal Reserve’s monetary policy will play a crucial role. Rising interest rates can dampen economic growth and make borrowing more expensive for companies, potentially negatively impacting the Nasdaq-100 and, consequently, TQQQ. Conversely, stable or declining interest rates could provide a boost to the market.

- Economic Growth: The overall health of the U.S. economy will be a significant driver. Strong economic growth typically leads to increased corporate earnings and higher stock prices, benefiting both the Nasdaq-100 and TQQQ. A recession or economic slowdown, however, could have the opposite effect.

- Inflation: Persistent inflation can erode corporate profits and consumer spending, potentially leading to a decline in stock prices. The Federal Reserve’s ability to control inflation will be a key determinant of market performance.

- Technological Innovation: The pace of technological innovation and adoption will continue to drive the growth of many companies in the Nasdaq-100. Breakthroughs in areas such as artificial intelligence, cloud computing, and electric vehicles could fuel significant gains for the index and TQQQ.

- Geopolitical Events: Global events, such as trade wars, political instability, or unexpected crises, can create market volatility and impact investor sentiment. These events can have both short-term and long-term effects on TQQQ’s performance.

- Investor Sentiment: Market psychology and investor confidence can significantly influence stock prices. Periods of optimism and bullish sentiment can drive prices higher, while fear and uncertainty can lead to sell-offs.

Scenario Analysis for TQQQ in 2025

To provide a more comprehensive TQQQ stock forecast for 2025, we’ve developed three potential scenarios:

Scenario 1: Bullish Outlook

Assumptions:

- The Federal Reserve maintains a dovish stance, keeping interest rates low.

- The U.S. economy experiences strong growth, driven by technological innovation and increased consumer spending.

- Inflation remains under control.

- Investor sentiment is positive, with a high degree of confidence in the market.

Potential TQQQ Performance: In this scenario, TQQQ could experience significant gains, potentially exceeding 50% or more. The Nasdaq-100 would likely reach new highs, and TQQQ’s leveraged nature would amplify these returns. However, investors should be aware that even in a bullish scenario, volatility remains a factor, and short-term pullbacks are possible.

Scenario 2: Neutral Outlook

Assumptions:

- The Federal Reserve gradually raises interest rates to combat inflation.

- The U.S. economy experiences moderate growth, with some sectors performing better than others.

- Inflation remains slightly above the Federal Reserve’s target.

- Investor sentiment is mixed, with some uncertainty about the future.

Potential TQQQ Performance: In a neutral scenario, TQQQ’s performance would likely be more subdued. The Nasdaq-100 could experience modest gains or remain relatively flat. Volatility decay could become a more significant factor, potentially eroding some of TQQQ’s returns. Investors may need to actively manage their positions to mitigate risk and capture potential gains.

Scenario 3: Bearish Outlook

Assumptions:

- The Federal Reserve aggressively raises interest rates to combat runaway inflation.

- The U.S. economy enters a recession, with declining corporate earnings and increased unemployment.

- Inflation remains stubbornly high.

- Investor sentiment turns negative, with widespread fear and uncertainty.

Potential TQQQ Performance: In a bearish scenario, TQQQ could experience significant losses. The Nasdaq-100 would likely decline sharply, and TQQQ’s leveraged nature would amplify these losses. Volatility decay would further exacerbate the negative impact. Investors should consider exiting their positions or employing hedging strategies to protect their capital.

Risk Management Strategies for TQQQ Investors

Given the inherent risks associated with TQQQ, effective risk management is essential. Here are some strategies to consider:

- Position Sizing: Limit your exposure to TQQQ to a small percentage of your overall portfolio. A general guideline is to allocate no more than 5-10% of your portfolio to leveraged ETFs.

- Stop-Loss Orders: Use stop-loss orders to automatically sell your TQQQ shares if the price falls below a certain level. This can help limit your potential losses.

- Hedging Strategies: Consider using options or other derivatives to hedge your TQQQ position. For example, you could purchase put options to protect against downside risk.

- Regular Monitoring: Closely monitor market conditions and your TQQQ position. Be prepared to adjust your strategy as needed.

- Understand Volatility Decay: Be aware of the potential for volatility decay and its impact on TQQQ’s long-term performance.

- Diversification: Don’t put all your eggs in one basket. Diversify your portfolio across different asset classes to reduce your overall risk.

TQQQ vs. Other Leveraged ETFs

While TQQQ is a popular choice for leveraged exposure to the Nasdaq-100, other leveraged ETFs exist. Some alternatives include:

- QLD: ProShares Ultra QQQ (2x leverage on the Nasdaq-100)

- TECL: Direxion Daily Technology Bull 3x Shares (3x leverage on the Technology Select Sector Index)

Each of these ETFs has its own unique characteristics and risk profile. Investors should carefully compare the different options before making a decision. TQQQ’s high leverage can be attractive to those seeking maximum returns, but it also carries the highest risk. QLD offers a more moderate level of leverage, while TECL focuses specifically on the technology sector.

The Role of Expert Analysis in Forecasting TQQQ

Forecasting the performance of a leveraged ETF like TQQQ is a complex task that requires a deep understanding of market dynamics, economic indicators, and the fund’s underlying mechanics. Expert analysis can provide valuable insights that help investors make informed decisions. Financial analysts and investment professionals use a variety of tools and techniques to assess the potential risks and rewards of investing in TQQQ. These include:

- Technical Analysis: Examining historical price and volume data to identify patterns and trends.

- Fundamental Analysis: Evaluating the financial health and growth prospects of the companies in the Nasdaq-100.

- Macroeconomic Analysis: Assessing the overall economic environment and its potential impact on the market.

- Quantitative Analysis: Using mathematical models and statistical techniques to forecast future performance.

While expert analysis can provide valuable guidance, it’s important to remember that forecasts are not guarantees. Market conditions can change rapidly, and unexpected events can significantly impact TQQQ’s performance. Investors should use expert analysis as one input in their decision-making process, but ultimately rely on their own judgment and risk tolerance.

Looking Ahead: Navigating the TQQQ Landscape in 2025

Predicting the future of any investment is inherently uncertain, and this is especially true for leveraged ETFs like TQQQ. However, by carefully considering the factors discussed in this article, investors can gain a better understanding of the potential risks and rewards associated with TQQQ in 2025. The interplay of interest rates, economic growth, inflation, technological innovation, and geopolitical events will shape the investment landscape. Remember that TQQQ is a tool best suited for sophisticated investors with a high-risk tolerance and a short-term investment horizon. Consider exploring our advanced guide to leveraged ETFs or contacting our experts for a personalized consultation to help you navigate the complexities of TQQQ and make informed investment decisions.