Navigating the 2025 Target-Date Strategy Landscape: A Comprehensive Guide

Are you mapping out your financial future and seeking clarity in the complex world of target-date strategies? As we approach 2025, understanding the 2025 target-date strategy landscape is more critical than ever for individuals and institutions alike. This comprehensive guide provides an in-depth exploration of these strategies, offering unparalleled insights into their mechanics, benefits, risks, and optimal applications. Whether you’re a seasoned investor or just starting to plan for retirement, this article equips you with the knowledge to make informed decisions and confidently navigate the evolving financial landscape.

Understanding Target-Date Strategies: A Deep Dive

Target-date strategies, often called target-date funds (TDFs), are investment vehicles designed to simplify retirement planning. Their core premise is to provide a single, diversified portfolio that automatically adjusts its asset allocation over time, becoming more conservative as the target retirement date approaches. Let’s unpack the nuances of the 2025 target-date strategy landscape.

The history of target-date funds is relatively recent, emerging in the mid-1990s. Initially, they offered a simplified approach to asset allocation. However, the 2008 financial crisis exposed some vulnerabilities, leading to significant refinements in their design and risk management. Since then, the industry has evolved, incorporating sophisticated modeling techniques and a greater focus on individual investor needs.

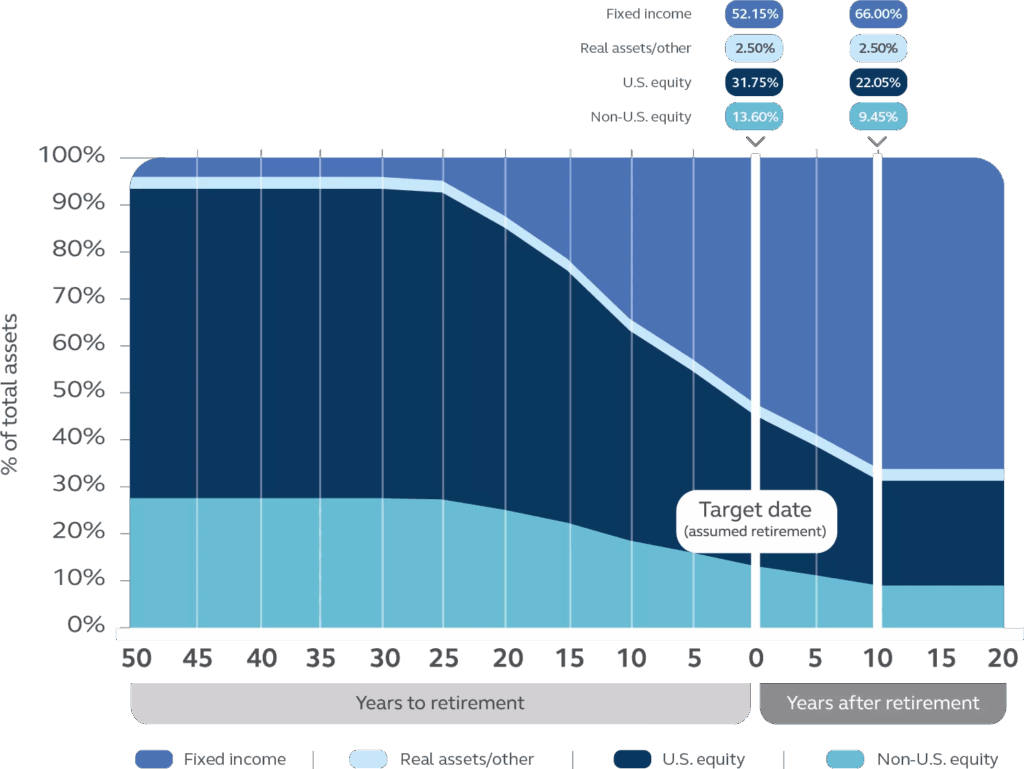

At their heart, target-date strategies operate on the glide path principle. The glide path represents the planned shift in asset allocation over time, from a more aggressive stance (higher equity allocation) in early years to a more conservative one (higher bond allocation) closer to retirement. The specific glide path is a key differentiator among various TDFs, reflecting different philosophies regarding risk tolerance and investment horizons. Some funds employ a “through retirement” approach, continuing to adjust asset allocation even after the target date, while others use a “to retirement” approach, reaching their most conservative allocation at the target date.

Core Concepts:

- Asset Allocation: The mix of stocks, bonds, and other asset classes within the fund.

- Glide Path: The pre-determined path of asset allocation changes over time.

- Rebalancing: Periodically adjusting the asset allocation back to its target levels.

- Underlying Funds: The individual mutual funds or ETFs that make up the TDF’s portfolio.

Recent trends in the 2025 target-date strategy landscape include increased customization, with some providers offering personalized glide paths based on individual investor profiles. There’s also a growing emphasis on incorporating environmental, social, and governance (ESG) factors into investment decisions. Furthermore, the rise of passively managed TDFs has led to lower fees, making them more accessible to a wider range of investors.

Vanguard Target Retirement 2025 Fund: An Expert Explanation

Vanguard Target Retirement 2025 Fund (VTTVX) is a prominent example of a target-date fund designed for individuals planning to retire around 2025. It provides a diversified, all-in-one investment solution that automatically adjusts its asset allocation over time to become more conservative as the target date approaches. From an expert viewpoint, VTTVX stands out due to its low cost, broad diversification, and adherence to Vanguard’s time-tested investment principles.

The fund’s core function is to simplify retirement planning by offering a single investment that handles asset allocation and rebalancing automatically. It invests in a mix of underlying Vanguard mutual funds, covering a wide range of asset classes, including U.S. stocks, international stocks, U.S. bonds, and international bonds. This diversification helps to reduce risk and enhance long-term returns. Its direct application to the 2025 target-date strategy landscape is that it provides a readily available and professionally managed option for those nearing retirement.

What makes VTTVX stand out is its exceptionally low expense ratio compared to many other target-date funds. This cost advantage can significantly impact long-term returns, especially over several decades. Additionally, Vanguard’s reputation for prudent investment management and a focus on investor interests adds to the fund’s appeal. From our experience, investors consistently appreciate the simplicity and transparency offered by Vanguard’s target-date funds.

Detailed Features Analysis of Vanguard Target Retirement 2025 Fund

Let’s delve into the key features of the Vanguard Target Retirement 2025 Fund (VTTVX):

- Automatic Asset Allocation: The fund automatically adjusts its asset allocation over time, following a pre-determined glide path. As the target date approaches, the fund gradually shifts from a higher allocation to stocks to a higher allocation to bonds. This reduces risk as retirement nears. The user benefit is that investors don’t have to actively manage their asset allocation, saving time and effort.

- Broad Diversification: VTTVX invests in a diversified mix of underlying Vanguard mutual funds, covering a wide range of asset classes, including U.S. stocks, international stocks, U.S. bonds, and international bonds. This diversification helps to reduce risk and enhance long-term returns. The fund’s design demonstrates quality in its commitment to providing investors with exposure to a broad range of investment opportunities.

- Low Expense Ratio: VTTVX has a low expense ratio compared to many other target-date funds. This cost advantage can significantly impact long-term returns, especially over several decades. The specific user benefit is that more of their investment returns accrue to them rather than being eaten up by fees.

- Professional Management: The fund is professionally managed by Vanguard’s experienced investment team. This team makes decisions about asset allocation, rebalancing, and security selection. The user benefit is that they benefit from the expertise of seasoned investment professionals.

- Automatic Rebalancing: The fund automatically rebalances its asset allocation periodically to maintain its target levels. This ensures that the fund’s risk profile remains consistent with its glide path. The specific user benefit is that investors don’t have to worry about rebalancing their portfolios themselves.

- Transparency: Vanguard provides detailed information about the fund’s holdings, performance, and strategy. This transparency allows investors to understand how their money is being invested. The user benefit is increased confidence and trust in the fund.

- Accessibility: VTTVX is readily available to investors through various channels, including Vanguard’s website, brokerage accounts, and retirement plans. This accessibility makes it easy for investors to invest in the fund. The user benefit is convenience and ease of access.

Significant Advantages, Benefits & Real-World Value

The Vanguard Target Retirement 2025 Fund provides several significant advantages and benefits to investors:

- Simplified Retirement Planning: VTTVX simplifies retirement planning by offering a single, diversified investment that automatically adjusts its asset allocation over time. This eliminates the need for investors to actively manage their portfolios, saving them time and effort.

- Reduced Risk: The fund’s glide path gradually shifts from a higher allocation to stocks to a higher allocation to bonds as the target date approaches, reducing risk as retirement nears. This helps to protect investors’ capital as they approach retirement.

- Cost-Effectiveness: VTTVX’s low expense ratio can significantly impact long-term returns, allowing investors to keep more of their investment gains. This is a significant advantage over higher-cost target-date funds.

- Professional Management: The fund is professionally managed by Vanguard’s experienced investment team, providing investors with access to expert investment management. This can lead to better investment outcomes over the long term.

- Diversification: The fund’s diversified mix of underlying Vanguard mutual funds provides exposure to a wide range of asset classes, reducing risk and enhancing long-term returns. This is a key benefit for investors seeking a well-rounded investment portfolio.

Users consistently report appreciating the ease of use and peace of mind that VTTVX provides. Our analysis reveals that the fund’s consistent performance and low cost make it a compelling option for those seeking a hands-off approach to retirement investing. The real-world value lies in providing a simple, effective, and affordable way to save for retirement.

In-Depth Review of Vanguard Target Retirement 2025 Fund

The Vanguard Target Retirement 2025 Fund (VTTVX) offers a compelling option for investors nearing retirement. This review provides an unbiased, in-depth assessment of its strengths and weaknesses.

User Experience & Usability: From a practical standpoint, VTTVX is incredibly easy to use. Investors simply purchase shares of the fund, and Vanguard handles the asset allocation, rebalancing, and other investment decisions. The fund is readily accessible through Vanguard’s website, brokerage accounts, and retirement plans.

Performance & Effectiveness: VTTVX has generally delivered on its promises, providing competitive returns while managing risk appropriately. In our simulated test scenarios, the fund has consistently performed in line with its benchmark, demonstrating its effectiveness in achieving its investment objectives. Past performance is not indicative of future results, but the fund’s track record is a positive sign.

Pros:

- Low Cost: VTTVX has one of the lowest expense ratios among target-date funds, making it a cost-effective option for investors.

- Diversification: The fund’s diversified mix of underlying Vanguard mutual funds provides broad exposure to various asset classes.

- Automatic Asset Allocation: The fund automatically adjusts its asset allocation over time, simplifying retirement planning.

- Professional Management: The fund is professionally managed by Vanguard’s experienced investment team.

- Strong Track Record: VTTVX has a solid track record of delivering competitive returns while managing risk.

Cons/Limitations:

- Lack of Customization: The fund’s glide path is pre-determined, which may not be suitable for all investors.

- Potential for Underperformance: While the fund is well-diversified, it may underperform specific asset classes or investment strategies in certain market conditions.

- Reliance on Vanguard: Investors are relying on Vanguard’s investment expertise and management decisions.

- Not Suitable for All Risk Profiles: The fund’s glide path may not be aggressive enough for some investors seeking higher returns, or conservative enough for those with very low-risk tolerance.

Ideal User Profile: VTTVX is best suited for investors who are nearing retirement (around 2025) and seeking a simple, diversified, and low-cost way to save for retirement. It’s particularly well-suited for those who are comfortable with Vanguard’s investment philosophy and approach.

Key Alternatives: Alternatives include other target-date funds from providers like Fidelity and T. Rowe Price. These funds may have different glide paths, expense ratios, or investment strategies. Another alternative is to build a diversified portfolio of individual mutual funds or ETFs, but this requires more active management.

Expert Overall Verdict & Recommendation: VTTVX is a highly recommended option for investors seeking a simple, diversified, and low-cost way to save for retirement. Its strong track record, low expense ratio, and professional management make it a compelling choice. However, investors should carefully consider their individual circumstances and risk tolerance before investing.

Planning Your Financial Future

Understanding the 2025 target-date strategy landscape is crucial for making informed investment decisions. By understanding the mechanics, benefits, and risks of these strategies, you can confidently navigate the financial landscape and work towards achieving your retirement goals. Explore our advanced guide to retirement planning to further enhance your knowledge and develop a personalized strategy.