Navigating Fiscal Years: Understanding the Calendar Shift in April 2025

Understanding fiscal years is crucial for businesses, governments, and individuals alike. They dictate budgeting, financial reporting, and strategic planning. A common question, especially as we approach new calendar years, is: what fiscal year are we in starting in april 2025? This article provides a comprehensive guide to understanding fiscal years, particularly in the context of a fiscal year beginning in April 2025, exploring its implications, and offering insights into its relevance.

Decoding the Fiscal Year Concept

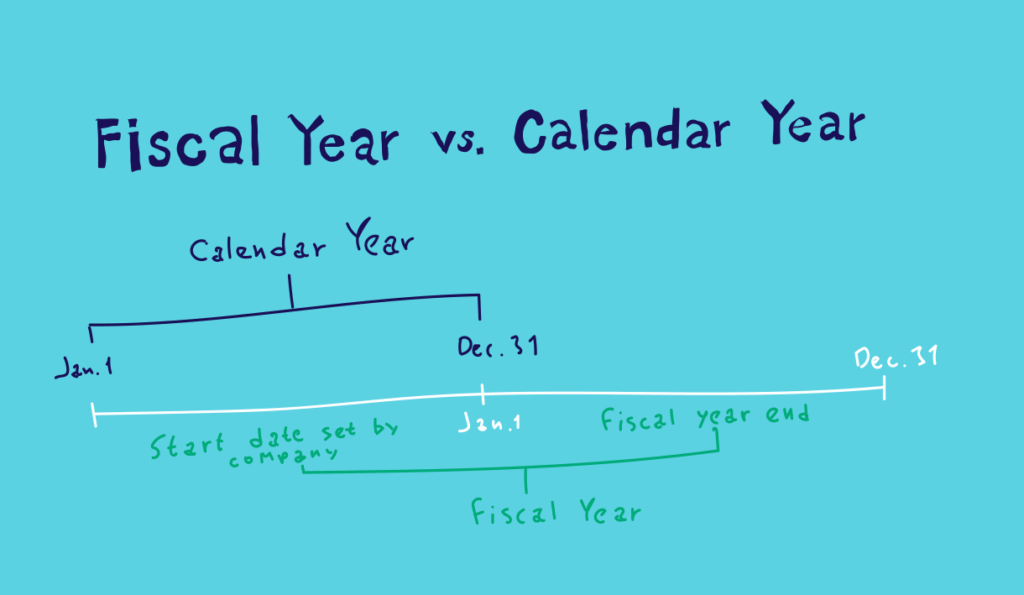

A fiscal year (FY), also known as a financial year, is a 12-month period that a company or organization uses for accounting and financial reporting. It doesn’t necessarily align with the calendar year (January 1st to December 31st). Instead, it can start at any point during the calendar year, depending on the entity’s specific needs and regulatory requirements. Understanding this deviation from the standard calendar year is fundamental to grasping the intricacies of financial planning and reporting.

The Significance of Choosing a Specific Fiscal Year Start Date

The selection of a fiscal year start date is a strategic decision. Many companies choose a fiscal year that aligns with their business cycle. For example, a retailer might have a fiscal year that ends in January, after the holiday shopping season, to capture all holiday-related revenue and expenses in one reporting period. This allows for a clearer picture of their financial performance during that critical time. Governments often align their fiscal years with their budgeting cycles to facilitate efficient resource allocation and financial management. As a result, the answer to “what fiscal year are we in starting in april 2025” will vary depending on the entity you’re asking about.

Key Differences Between Fiscal and Calendar Years

The primary difference is simple: a calendar year always runs from January 1st to December 31st, while a fiscal year is any 12-month period an organization designates for financial reporting. This distinction is vital because it affects how financial data is collected, analyzed, and compared. When comparing financial results across different entities, it’s essential to consider their respective fiscal year start and end dates to ensure accurate comparisons.

Fiscal Year 2025: A Detailed Examination

So, let’s address the core question: what fiscal year are we in starting in april 2025? The answer depends on the specific context. For entities with a fiscal year beginning in April, the period from April 2025 to March 2026 would be considered Fiscal Year 2025 (or sometimes FY25). It’s crucial to understand that the fiscal year is often labeled by the year in which it begins. However, some organizations may label it by the year in which it ends.

Examples of Fiscal Year Designations

- Company A, with a fiscal year starting in April, would likely refer to the period from April 2025 to March 2026 as FY2025.

- Government B, also starting its fiscal year in April, might similarly use FY2025, or it could opt for FY2026, depending on its internal conventions.

It’s vital to clarify which convention is being used when discussing fiscal years to avoid confusion. In contexts where precision is paramount, explicitly stating the start and end dates of the fiscal period is always the best approach.

Why April? The Rationale Behind an April Fiscal Year Start

Several factors can influence an organization’s decision to begin its fiscal year in April. In some countries, like Japan and India, the government’s fiscal year starts in April. Companies operating in these regions might align their fiscal year to match the government’s for ease of compliance and comparison. Other reasons include aligning with specific industry cycles, seasonal revenue patterns, or historical precedent. In many cases, it’s simply a matter of established practice within a particular organization or sector.

Tools and Resources for Fiscal Year Management

Managing fiscal years effectively requires the right tools and resources. A crucial aspect of fiscal year management involves accurate financial software. Programs like QuickBooks, SAP, and Oracle NetSuite are invaluable for tracking income, expenses, and other financial data throughout the fiscal year. These tools provide robust reporting capabilities, enabling organizations to generate financial statements and analyze performance against budgetary targets.

Budgeting and Forecasting Software: A Closer Look

Budgeting and forecasting software, such as Adaptive Insights and Anaplan, are essential for planning and resource allocation. These tools allow organizations to create detailed budgets, forecast future financial performance, and model different scenarios. By integrating with accounting software, they provide a comprehensive view of the organization’s financial health and facilitate informed decision-making.

Compliance and Regulatory Reporting Solutions

Compliance and regulatory reporting solutions are vital for ensuring that organizations meet their legal and regulatory obligations. These solutions help companies track changes in accounting standards, tax laws, and other regulations, and automate the preparation of required reports. Examples include Thomson Reuters ONESOURCE and Wolters Kluwer CCH Tagetik. They are particularly important for organizations operating in multiple jurisdictions with varying regulatory requirements.

Features of Comprehensive Financial Management Systems

Modern financial management systems offer a wide range of features to streamline fiscal year operations. These features include:

- Automated Financial Reporting: Automatically generates financial statements, such as income statements, balance sheets, and cash flow statements, based on real-time data. This saves time and reduces the risk of errors.

- Budgeting and Forecasting: Enables organizations to create detailed budgets, forecast future financial performance, and model different scenarios.

- Expense Management: Tracks and manages employee expenses, ensuring compliance with company policies and regulatory requirements.

- Tax Compliance: Automates the calculation and filing of taxes, reducing the risk of penalties and ensuring compliance with tax laws.

- Audit Trail: Maintains a detailed record of all financial transactions, providing transparency and facilitating audits.

- Integration with Other Systems: Integrates with other business systems, such as CRM and ERP, to provide a comprehensive view of the organization’s financial health.

- Data Analytics: Provides advanced data analytics capabilities, enabling organizations to identify trends, patterns, and opportunities for improvement.

These features, when used effectively, can significantly improve the efficiency and accuracy of fiscal year management.

Advantages of Effective Fiscal Year Planning

Effective fiscal year planning offers numerous advantages. It enables better financial control, improved decision-making, and enhanced strategic alignment. When organizations have a clear understanding of their financial performance and future prospects, they can make more informed decisions about investments, resource allocation, and strategic initiatives. This leads to improved profitability, increased efficiency, and enhanced competitiveness.

Enhanced Financial Control and Transparency

With robust financial management systems and processes, organizations can gain better control over their finances. This includes tracking income and expenses, monitoring cash flow, and managing assets and liabilities. Enhanced transparency allows stakeholders to have a clear understanding of the organization’s financial health, fostering trust and confidence.

Improved Decision-Making and Strategic Alignment

Effective fiscal year planning provides valuable insights that support better decision-making. By analyzing financial data and trends, organizations can identify opportunities for growth, areas for improvement, and potential risks. This enables them to align their strategic initiatives with their financial goals, ensuring that resources are allocated effectively and that the organization is positioned for long-term success.

Real-World Value and Impact

The real-world value of effective fiscal year planning is evident in the improved financial performance and strategic outcomes of organizations. Companies that prioritize fiscal year management are better equipped to navigate economic challenges, capitalize on market opportunities, and achieve their long-term goals. This translates into increased shareholder value, improved employee morale, and a stronger competitive position.

A Closer Look at Financial Planning Software: A Review

Let’s examine one of the leading financial planning software packages, Adaptive Insights (now Workday Adaptive Planning), to illustrate the benefits and limitations of such tools. Adaptive Insights is a cloud-based platform designed for budgeting, forecasting, and reporting. It offers a wide range of features, including automated financial reporting, scenario planning, and collaborative budgeting.

User Experience and Usability

Adaptive Insights is known for its user-friendly interface and intuitive design. The platform is easy to navigate, and users can quickly access the features they need. The drag-and-drop functionality simplifies the creation of reports and dashboards. However, some users have reported that the initial setup and configuration can be complex, requiring technical expertise.

Performance and Effectiveness

Adaptive Insights delivers on its promises of improved financial planning and forecasting. The platform’s automated reporting capabilities save time and reduce the risk of errors. The scenario planning feature allows organizations to model different scenarios and assess the potential impact on their financial performance. However, the platform can be slow when processing large amounts of data.

Pros

- User-friendly interface

- Automated financial reporting

- Scenario planning capabilities

- Collaborative budgeting features

- Integration with other systems

Cons/Limitations

- Complex initial setup

- Can be slow when processing large amounts of data

- Relatively expensive compared to other solutions

- Limited customization options

Ideal User Profile

Adaptive Insights is best suited for mid-sized to large organizations with complex financial planning needs. It is particularly well-suited for companies that require collaborative budgeting, scenario planning, and automated financial reporting.

Key Alternatives

Key alternatives to Adaptive Insights include Anaplan and Oracle NetSuite. Anaplan offers similar features but is generally considered more complex and expensive. Oracle NetSuite is a comprehensive ERP system that includes financial planning capabilities, but it may be overkill for organizations that only need financial planning software.

Expert Overall Verdict & Recommendation

Adaptive Insights is a powerful and effective financial planning software package that can significantly improve an organization’s budgeting, forecasting, and reporting processes. While it has some limitations, its user-friendly interface, automated reporting capabilities, and scenario planning features make it a valuable tool for organizations of all sizes. We recommend Adaptive Insights for organizations that need a robust and scalable financial planning solution.

Key Takeaways for Fiscal Year Understanding

In summary, understanding fiscal years is essential for effective financial management and strategic planning. As we look ahead to April 2025, remember that the fiscal year designation depends on the specific organization and its chosen start date. By leveraging the right tools and resources, organizations can streamline their fiscal year operations, improve decision-making, and achieve their financial goals. The question of “what fiscal year are we in starting in april 2025” isn’t just a calendar exercise; it’s about strategic alignment and financial clarity. Share your experiences with fiscal year planning in the comments below.