Dollar to Rand Prediction 2025: Expert Analysis and Future Outlook

Navigating the complexities of currency exchange rates is crucial for businesses, investors, and individuals engaged in international transactions. Predicting the future value of a currency pair like the dollar to rand (USD/ZAR) is notoriously challenging, yet understanding the factors that influence it is vital for informed decision-making. This article provides an in-depth analysis of the potential trajectory of the dollar to rand exchange rate in 2025, considering a range of economic, political, and global factors. We will explore various prediction models, expert opinions, and potential scenarios to offer a comprehensive outlook for anyone seeking clarity on the dollar to rand exchange rate in the coming year. Our goal is to equip you with the knowledge necessary to understand the risks and opportunities associated with this volatile currency pair.

Understanding the Dynamics of USD/ZAR Exchange Rate

The dollar to rand exchange rate is influenced by a complex interplay of factors, ranging from macroeconomic indicators to geopolitical events. A thorough understanding of these drivers is essential for anyone attempting to forecast its future movements. These include:

- Interest Rate Differentials: The difference in interest rates between the US Federal Reserve and the South African Reserve Bank (SARB) can significantly impact capital flows and, consequently, the exchange rate. Higher interest rates in South Africa may attract foreign investment, strengthening the rand.

- Inflation Rates: Inflation erodes the purchasing power of a currency. Higher inflation in South Africa relative to the United States can weaken the rand.

- Economic Growth: The relative economic performance of the US and South Africa plays a crucial role. Stronger US growth typically strengthens the dollar, while robust South African growth can support the rand.

- Commodity Prices: South Africa is a major exporter of commodities such as gold, platinum, and coal. Fluctuations in commodity prices can significantly impact the country’s export earnings and, consequently, the rand’s value.

- Political Stability and Policy: Political uncertainty, policy changes, and governance issues in South Africa can negatively affect investor confidence and weaken the rand.

- Global Risk Sentiment: In times of global economic uncertainty or crisis, investors often seek safe-haven assets like the US dollar, leading to a strengthening of the dollar against emerging market currencies like the rand.

The dynamic interplay of these factors makes precise forecasting exceptionally difficult, but understanding their influence is crucial for informed analysis.

Economic Forecasts and Expert Opinions for 2025

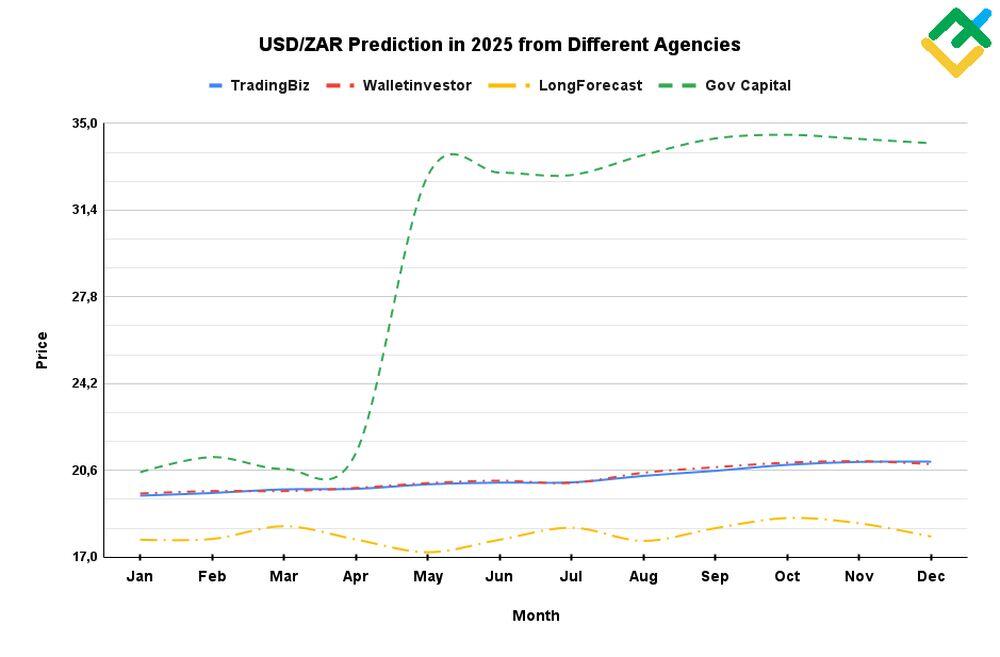

Several institutions and experts provide forecasts for the USD/ZAR exchange rate. These predictions are often based on complex economic models and analysis of the factors mentioned above. However, it’s crucial to remember that these are just predictions, and actual outcomes can vary significantly.

Leading financial institutions, such as major investment banks and international organizations like the International Monetary Fund (IMF), regularly publish their forecasts for the USD/ZAR exchange rate. These forecasts often incorporate assumptions about future economic growth, inflation, interest rates, and commodity prices.

Independent economic analysts and research firms also provide valuable insights. Their analysis may focus on specific aspects of the South African or US economy, offering a more granular perspective on the potential drivers of the exchange rate.

It is important to compare forecasts from multiple sources and consider the underlying assumptions. A consensus view, while not necessarily accurate, can provide a more balanced perspective on the potential range of outcomes.

Different Prediction Models and Their Applications

Various models are employed to predict currency exchange rates, each with its own strengths and limitations. Understanding the different types of models can help you evaluate the credibility and potential accuracy of forecasts.

- Purchasing Power Parity (PPP): This theory suggests that exchange rates should adjust to equalize the price of a basket of goods and services in different countries. While PPP can be a useful long-term benchmark, it often fails to accurately predict short-term exchange rate movements.

- Interest Rate Parity (IRP): This theory posits that the difference in interest rates between two countries should be equal to the expected change in the exchange rate. IRP can be a useful tool for understanding the relationship between interest rates and exchange rates, but it is often influenced by other factors.

- Econometric Models: These models use statistical techniques to analyze historical data and identify relationships between economic variables and exchange rates. Econometric models can be complex and require significant expertise to develop and interpret.

- Time Series Analysis: This approach uses historical exchange rate data to identify patterns and trends that can be used to predict future movements. Time series analysis can be useful for short-term forecasting, but it may not be reliable for longer-term predictions.

- Machine Learning Models: With the advent of big data and advanced computing power, machine learning models are increasingly being used to predict exchange rates. These models can identify complex patterns and relationships that may not be apparent to traditional methods.

Each model has its own assumptions and limitations. No single model is perfect, and it’s important to consider the results of multiple models when making informed decisions.

Potential Scenarios for USD/ZAR in 2025

Given the inherent uncertainty in forecasting currency exchange rates, it’s helpful to consider a range of potential scenarios. These scenarios should be based on different assumptions about key economic and political factors.

Scenario 1: Base Case (Moderate Growth and Stability)

In this scenario, both the US and South African economies experience moderate growth. Inflation remains under control, and interest rates are gradually adjusted to maintain economic stability. Political stability is maintained in South Africa, and there are no major global economic shocks. In this scenario, the USD/ZAR exchange rate is expected to remain relatively stable, with moderate fluctuations around its current level. This is a scenario where the rand will neither strengthen nor weaken drastically against the dollar.

Scenario 2: Bullish Rand (Strong Commodity Prices and Reform)

This scenario assumes that commodity prices rise sharply, boosting South Africa’s export earnings. The South African government implements significant economic reforms, attracting foreign investment and improving investor confidence. The US economy experiences slower growth, and the Federal Reserve maintains low interest rates. In this scenario, the rand is expected to strengthen against the dollar. This is a scenario where the rand is expected to perform very well against the dollar.

Scenario 3: Bearish Rand (Global Recession and Political Instability)

This scenario assumes a global recession, leading to a sharp decline in commodity prices. Political instability in South Africa increases, eroding investor confidence. The US economy remains resilient, and the Federal Reserve raises interest rates to combat inflation. In this scenario, the rand is expected to weaken significantly against the dollar. This is a scenario where the rand is expected to perform very poorly against the dollar.

By considering these different scenarios, you can better understand the potential range of outcomes and prepare for different possibilities.

The Role of Global Events and Geopolitical Factors

Global events and geopolitical factors can have a significant impact on currency exchange rates. Unexpected events, such as wars, natural disasters, or political crises, can trigger sudden and substantial movements in the USD/ZAR exchange rate.

Trade wars or changes in trade policy can also affect the exchange rate. For example, increased tariffs on South African exports to the US could weaken the rand.

Monitoring global events and geopolitical developments is crucial for anyone seeking to understand the potential risks and opportunities associated with the USD/ZAR exchange rate.

Risk Management Strategies for Businesses and Investors

Given the volatility of the USD/ZAR exchange rate, businesses and investors need to implement effective risk management strategies. These strategies can help to mitigate the potential negative impact of exchange rate fluctuations.

- Hedging: Hedging involves using financial instruments, such as forward contracts or options, to lock in a future exchange rate. This can provide certainty and protect against adverse movements in the exchange rate.

- Diversification: Diversifying investments across different currencies and asset classes can reduce exposure to exchange rate risk.

- Natural Hedging: Natural hedging involves matching revenues and expenses in the same currency. For example, a South African company that exports goods to the US and receives payment in dollars can use those dollars to pay for imports from the US, thereby reducing its exposure to exchange rate risk.

- Currency Risk Insurance: Some insurance companies offer currency risk insurance, which can protect businesses against losses due to exchange rate fluctuations.

The choice of risk management strategy will depend on the specific circumstances of the business or investor, their risk tolerance, and their financial goals.

The South African Reserve Bank’s (SARB) Influence

The South African Reserve Bank (SARB) plays a crucial role in managing the rand’s value. The SARB’s monetary policy decisions, particularly its interest rate policy, can significantly impact the exchange rate.

The SARB also intervenes in the foreign exchange market to stabilize the rand or to achieve specific policy objectives. These interventions can take the form of buying or selling rand, or adjusting reserve requirements for banks.

Understanding the SARB’s policy objectives and its likely response to different economic scenarios is essential for anyone seeking to predict the future direction of the USD/ZAR exchange rate.

Expert Insights on Long-Term Trends

While short-term predictions are inherently uncertain, experts often have insights into long-term trends that can provide valuable context. Some common perspectives include:

- The impact of global economic shifts: Major shifts in the global economy, such as the rise of China or changes in US trade policy, can have long-lasting effects on the USD/ZAR exchange rate.

- The role of technological innovation: Technological advancements can impact productivity, competitiveness, and trade patterns, all of which can influence the exchange rate.

- The importance of sustainable development: Environmental concerns and the transition to a green economy can create new opportunities and challenges for South Africa, affecting its currency.

The Impact of US Monetary Policy on the Rand

The monetary policy decisions of the United States Federal Reserve (the Fed) have a profound impact on global financial markets, including the USD/ZAR exchange rate. When the Fed raises interest rates, it typically strengthens the US dollar, as higher rates attract capital flows into the US. Conversely, when the Fed lowers interest rates, it tends to weaken the dollar.

The Fed’s policy decisions are driven by its dual mandate of maintaining price stability and maximizing employment. When inflation is high, the Fed is likely to raise interest rates to cool down the economy. When the economy is weak, the Fed is likely to lower interest rates to stimulate growth.

The impact of US monetary policy on the rand can be significant. A stronger dollar can make South African exports more expensive and imports cheaper, potentially widening the trade deficit. It can also increase the cost of servicing South Africa’s dollar-denominated debt.

Analyzing South Africa’s Economic Outlook

South Africa’s economic outlook is a critical factor in determining the future value of the rand. Key indicators to watch include:

- GDP Growth: Strong GDP growth indicates a healthy economy and can support the rand.

- Inflation: High inflation erodes the purchasing power of the rand and can lead to its depreciation.

- Unemployment: High unemployment can put downward pressure on wages and consumer spending, weakening the economy and the rand.

- Current Account Balance: A current account deficit, where imports exceed exports, can weaken the rand.

- Government Debt: High levels of government debt can raise concerns about the country’s ability to repay its obligations, potentially weakening the rand.

Improvements in South Africa’s economic outlook, such as increased investment, improved productivity, or reduced corruption, can strengthen the rand.

The Role of Credit Rating Agencies

Credit rating agencies, such as Moody’s, Standard & Poor’s, and Fitch, assess the creditworthiness of countries and companies. Their ratings can significantly impact investor sentiment and capital flows.

A downgrade in South Africa’s credit rating can lead to capital outflows and a weakening of the rand. Conversely, an upgrade can attract foreign investment and strengthen the rand.

Monitoring the assessments and outlooks of credit rating agencies is important for understanding the potential risks and opportunities associated with the USD/ZAR exchange rate.

Alternative Investment Strategies in a Volatile Market

Given the volatility of the USD/ZAR exchange rate, investors may consider alternative investment strategies to protect their capital and generate returns. These strategies can include:

- Investing in Rand-Hedged Assets: These assets provide exposure to South African markets while mitigating exchange rate risk.

- Diversifying into Other Emerging Markets: Spreading investments across different emerging markets can reduce exposure to the specific risks of South Africa.

- Investing in Hard Assets: Assets such as gold or real estate can provide a hedge against inflation and currency depreciation.

- Utilizing Options Strategies: Options can be used to protect against downside risk or to profit from anticipated exchange rate movements.

The choice of investment strategy will depend on the investor’s risk tolerance, investment goals, and time horizon.

Looking Ahead: Preparing for the Future of USD/ZAR

Predicting the dollar to rand exchange rate in 2025 requires a comprehensive understanding of various economic, political, and global factors. While precise forecasting remains challenging, staying informed about these drivers and considering a range of potential scenarios can help businesses, investors, and individuals make more informed decisions. Remember to consult with financial professionals and conduct thorough research before making any investment or financial decisions based on these predictions.

Share your thoughts and experiences with currency exchange in the comments below. Your insights contribute to a richer understanding of this complex topic.