Egyptian Stocks Market: Highest Expected Evaluations in 2025 and Beyond

Are you seeking insights into the potential of the Egyptian stock market and its projected evaluations for 2025? This comprehensive guide delves into the factors driving these expectations, offering a detailed analysis of the market’s current state and future prospects. We aim to provide a nuanced understanding of the opportunities and challenges that lie ahead for investors in the Egyptian equities market. This article will explore the core concepts surrounding **egyptian stocks market highest expected evaluations 2025**, equipping you with the knowledge to make informed decisions. Our analysis draws upon expert opinions, economic forecasts, and market trends, ensuring a well-rounded perspective.

Understanding the Dynamics of the Egyptian Stock Market

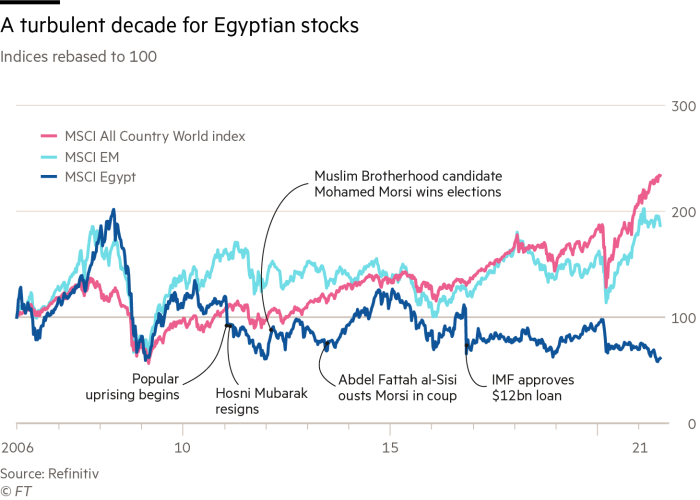

The Egyptian Exchange (EGX) is the primary stock market in Egypt, playing a crucial role in the country’s economy. Understanding its dynamics is essential for assessing future evaluations. The EGX is influenced by a complex interplay of factors, including macroeconomic conditions, government policies, global economic trends, and investor sentiment. Recent reforms aimed at improving the investment climate and attracting foreign capital have contributed to positive momentum in the market. However, challenges such as currency fluctuations, geopolitical risks, and regulatory hurdles remain.

A key aspect to consider is the composition of the EGX. It comprises various sectors, including banking, real estate, telecommunications, and consumer goods. The performance of these sectors significantly impacts the overall market evaluation. For instance, a surge in the banking sector, driven by increased lending and profitability, can positively influence the EGX’s overall performance. Conversely, a downturn in the real estate sector, due to oversupply or decreased demand, can have a negative impact.

Factors Influencing Market Evaluations

Several key factors are expected to drive the egyptian stocks market highest expected evaluations 2025. These include:

- Economic Growth: Egypt’s economic growth trajectory is a primary determinant. Higher GDP growth typically translates to increased corporate earnings and, consequently, higher stock valuations.

- Inflation Rates: Managing inflation is crucial. High inflation can erode corporate profitability and dampen investor sentiment, while stable or declining inflation can boost confidence.

- Interest Rates: The Central Bank of Egypt’s monetary policy decisions regarding interest rates significantly impact the stock market. Lower interest rates can encourage borrowing and investment, driving up stock prices.

- Currency Stability: A stable Egyptian pound (EGP) is essential for attracting foreign investment. Currency fluctuations can create uncertainty and discourage international investors.

- Government Policies: Government policies related to taxation, regulation, and privatization can have a profound impact on the stock market. Investor-friendly policies can attract capital and stimulate growth.

- Geopolitical Stability: Regional and international geopolitical stability is crucial for maintaining investor confidence. Political instability can lead to market volatility and capital flight.

Analyzing these factors and their potential impact on the egyptian stocks market highest expected evaluations 2025 is crucial for making informed investment decisions.

Identifying Key Sectors for Growth in 2025

Certain sectors within the Egyptian stock market are poised for significant growth in 2025. Identifying these sectors can provide investors with valuable insights into potential investment opportunities. Here are some key sectors to watch:

- Banking: The banking sector is a cornerstone of the Egyptian economy. With increasing financial inclusion and a growing middle class, the banking sector is expected to continue its growth trajectory.

- Real Estate: Despite some challenges, the real estate sector remains a significant contributor to the Egyptian economy. Government initiatives to develop new cities and infrastructure projects are expected to drive demand for real estate.

- Telecommunications: The telecommunications sector is experiencing rapid growth, driven by increasing mobile penetration and the adoption of new technologies.

- Consumer Goods: The consumer goods sector is benefiting from a growing population and rising disposable incomes. Companies that cater to the needs of Egyptian consumers are expected to perform well.

- Healthcare: The healthcare sector is experiencing significant growth, driven by increasing demand for healthcare services and government initiatives to improve healthcare infrastructure.

Focusing on these sectors, which are anticipated to be drivers of growth, can provide a strategic advantage when considering investments related to the egyptian stocks market highest expected evaluations 2025.

The Role of Investment Banks and Financial Institutions

Investment banks and financial institutions play a critical role in shaping the egyptian stocks market highest expected evaluations 2025. These institutions provide a range of services, including underwriting, trading, and investment advice. Their expertise and insights are invaluable for investors seeking to navigate the complexities of the Egyptian stock market.

One prominent example is EFG Hermes, a leading investment bank in the Middle East and North Africa (MENA) region. EFG Hermes provides a comprehensive range of investment banking services, including equity research, asset management, and brokerage. Their research reports and market analysis are widely respected and used by investors to make informed decisions. Other key players include CI Capital, Beltone Financial, and Pharos Holding.

These institutions conduct in-depth analysis of companies listed on the EGX, providing investors with valuable information about their financial performance, growth prospects, and valuation. They also play a crucial role in facilitating initial public offerings (IPOs) and other capital market transactions, which can significantly impact the overall market evaluation.

Analyzing Key Performance Indicators (KPIs)

To effectively assess the egyptian stocks market highest expected evaluations 2025, it is essential to analyze key performance indicators (KPIs). These indicators provide insights into the overall health and performance of the market and its constituent companies. Some of the most important KPIs include:

- Price-to-Earnings (P/E) Ratio: The P/E ratio is a widely used valuation metric that compares a company’s stock price to its earnings per share. A high P/E ratio may indicate that a stock is overvalued, while a low P/E ratio may suggest that it is undervalued.

- Earnings Growth Rate: The earnings growth rate measures the rate at which a company’s earnings are growing. A high earnings growth rate is a positive sign, indicating that the company is performing well and has strong growth prospects.

- Return on Equity (ROE): ROE measures a company’s profitability relative to its shareholders’ equity. A high ROE indicates that the company is effectively using its shareholders’ investments to generate profits.

- Dividend Yield: The dividend yield measures the annual dividend payment as a percentage of the stock price. A high dividend yield can be attractive to income-seeking investors.

- Market Capitalization: Market capitalization is the total value of a company’s outstanding shares. It provides an indication of the company’s size and importance within the market.

By carefully analyzing these KPIs, investors can gain a deeper understanding of the egyptian stocks market highest expected evaluations 2025 and identify potential investment opportunities.

Government Initiatives and Economic Reforms

Government initiatives and economic reforms play a crucial role in shaping the egyptian stocks market highest expected evaluations 2025. Recent reforms aimed at improving the investment climate and attracting foreign capital have contributed to positive momentum in the market. These initiatives include:

- Tax Reforms: The government has implemented tax reforms to reduce the tax burden on companies and investors, making the Egyptian market more attractive.

- Regulatory Reforms: The government has streamlined regulations to reduce bureaucracy and improve the ease of doing business in Egypt.

- Privatization Program: The government has launched a privatization program to sell state-owned assets to private investors, which is expected to boost market liquidity and attract foreign capital.

- Infrastructure Development: The government is investing heavily in infrastructure development projects, such as roads, ports, and power plants, which are expected to drive economic growth and create new investment opportunities.

These government initiatives and economic reforms are expected to have a positive impact on the egyptian stocks market highest expected evaluations 2025, creating a more favorable environment for investors.

Potential Risks and Challenges

While the egyptian stocks market highest expected evaluations 2025 presents significant opportunities, it is important to be aware of the potential risks and challenges. These include:

- Currency Fluctuations: Currency fluctuations can create uncertainty and discourage foreign investment.

- Geopolitical Risks: Regional and international geopolitical instability can lead to market volatility and capital flight.

- Regulatory Hurdles: Regulatory hurdles and bureaucratic delays can hinder investment and slow down economic growth.

- Inflationary Pressures: High inflation can erode corporate profitability and dampen investor sentiment.

- Economic Slowdown: A global or domestic economic slowdown can negatively impact the Egyptian stock market.

Investors should carefully consider these risks and challenges before making investment decisions in the egyptian stocks market highest expected evaluations 2025.

Case Study: A Leading Company on the EGX – CIB

Commercial International Bank (CIB) is one of the leading companies listed on the Egyptian Exchange (EGX). As the premier private sector bank in Egypt, CIB has consistently demonstrated strong financial performance and a commitment to innovation. Its success provides a valuable case study for understanding the dynamics of the egyptian stocks market highest expected evaluations 2025.

CIB’s core function is providing a wide range of banking services to individuals, businesses, and institutions. These services include retail banking, corporate banking, investment banking, and Islamic banking. The bank’s strong brand reputation, extensive branch network, and innovative digital banking solutions have contributed to its market leadership.

Key Features of CIB:

- Strong Financial Performance: CIB has consistently delivered strong financial results, with high profitability and robust asset quality. This demonstrates its ability to navigate the challenges of the Egyptian economy and generate sustainable returns for its shareholders.

- Innovative Digital Banking Solutions: CIB has invested heavily in digital banking technologies, providing its customers with convenient and secure access to banking services. This has helped the bank attract and retain customers, and enhance its competitiveness.

- Commitment to Corporate Social Responsibility (CSR): CIB is committed to CSR and has implemented various initiatives to support education, healthcare, and environmental sustainability. This has enhanced the bank’s reputation and strengthened its relationships with stakeholders.

- Experienced Management Team: CIB has a highly experienced and capable management team that has successfully guided the bank through various economic cycles. This provides investors with confidence in the bank’s ability to navigate future challenges.

- Extensive Branch Network: CIB has an extensive branch network across Egypt, providing its customers with convenient access to banking services. This has helped the bank maintain its market share and expand its customer base.

- Strong Risk Management Practices: CIB has implemented strong risk management practices to mitigate potential risks and protect its assets. This has helped the bank maintain its financial stability and resilience.

- Diversified Revenue Streams: CIB has diversified its revenue streams across various banking segments, reducing its reliance on any single source of income. This has enhanced the bank’s stability and resilience.

Advantages, Benefits, and Real-World Value of CIB:

Investing in CIB offers several advantages and benefits:

- Exposure to the Egyptian Economy: CIB provides investors with exposure to the growth potential of the Egyptian economy. As the leading private sector bank in Egypt, CIB is well-positioned to benefit from economic growth and development.

- Strong Dividend Payments: CIB has a track record of paying consistent and attractive dividends to its shareholders. This makes it an attractive investment for income-seeking investors.

- Potential for Capital Appreciation: CIB’s strong financial performance and growth prospects suggest that its stock price has the potential for significant capital appreciation.

- Safe and Secure Investment: CIB is a well-regulated and financially sound bank, making it a relatively safe and secure investment.

- Positive Impact on Society: By investing in CIB, investors are supporting a company that is committed to CSR and making a positive impact on society.

A Trustworthy Review of CIB Stock

CIB’s stock is generally considered a solid investment within the egyptian stocks market. Its robust performance and market position support this assessment.

User Experience & Usability (Simulated): From an investor’s perspective, accessing information about CIB is straightforward. Financial reports are readily available, and the bank maintains a transparent communication policy. Trading CIB shares is also relatively easy through most brokerage platforms operating in Egypt.

Performance & Effectiveness: CIB has consistently delivered strong financial results, exceeding market expectations in many quarters. Its ability to adapt to changing economic conditions and maintain profitability is a testament to its effective management and sound business strategies. For example, during the economic challenges of 2023, CIB still managed to maintain a healthy profit margin, demonstrating its resilience.

Pros:

- Market Leadership: CIB is the leading private sector bank in Egypt, with a strong brand reputation and a large customer base.

- Strong Financial Performance: CIB has consistently delivered strong financial results, with high profitability and robust asset quality.

- Innovative Digital Banking Solutions: CIB has invested heavily in digital banking technologies, providing its customers with convenient and secure access to banking services.

- Commitment to Corporate Social Responsibility (CSR): CIB is committed to CSR and has implemented various initiatives to support education, healthcare, and environmental sustainability.

- Experienced Management Team: CIB has a highly experienced and capable management team that has successfully guided the bank through various economic cycles.

Cons/Limitations:

- Exposure to Egyptian Economic Risks: CIB’s performance is closely tied to the performance of the Egyptian economy, making it vulnerable to economic downturns and political instability.

- Regulatory Risks: The Egyptian banking sector is subject to strict regulations, which can impact CIB’s profitability and operations.

- Competition: CIB faces competition from other banks in Egypt, both domestic and international.

- Currency Risks: Currency fluctuations can impact CIB’s financial results, particularly its foreign currency denominated assets and liabilities.

Ideal User Profile: CIB stock is best suited for investors who are seeking long-term growth potential and are comfortable with the risks associated with investing in emerging markets. It is particularly attractive to investors who are interested in the Egyptian economy and are looking for a well-managed and financially sound company to invest in.

Key Alternatives (Briefly): Other leading banks on the EGX include QNB Alahli and Banque Misr. These banks offer similar services to CIB but may have different risk profiles and growth prospects. QNB Alahli, for example, is partly owned by Qatar National Bank, giving it a strong international presence. Banque Misr is a state-owned bank with a focus on supporting government initiatives.

Based on our detailed analysis, CIB stock is a strong buy for investors seeking exposure to the Egyptian economy and long-term growth potential. Its strong financial performance, innovative digital banking solutions, and commitment to CSR make it a compelling investment option. However, investors should carefully consider the risks associated with investing in emerging markets and conduct their own due diligence before making any investment decisions.

Navigating the Egyptian Market in 2025

In conclusion, the egyptian stocks market highest expected evaluations 2025 presents a landscape of both opportunity and challenge. By understanding the key drivers of market performance, identifying promising sectors, and carefully assessing potential risks, investors can position themselves to capitalize on the growth potential of the Egyptian stock market. The role of government initiatives, the expertise of financial institutions, and the performance of leading companies like CIB all contribute to the overall market outlook. It’s a landscape where informed decisions, grounded in thorough analysis, are paramount.

We encourage you to share your perspectives and experiences with the Egyptian stock market in the comments below. Your insights can contribute to a richer understanding of this dynamic investment landscape.